Which of the Following Is a Mandatory Payroll Deduction

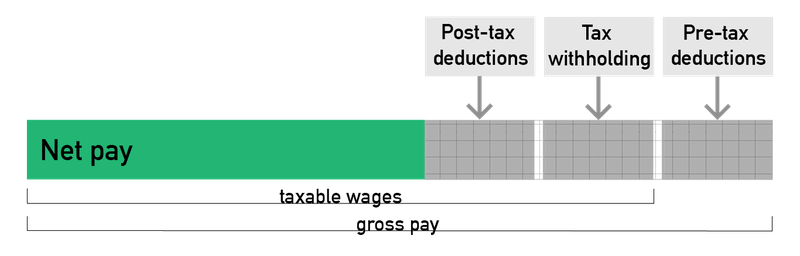

Form W-2 reports only taxable earnings which may not equal total gross earnings. Therefore the AP Government remunerates salaries and pensions from January 2022 in the revised pay scale 2022.

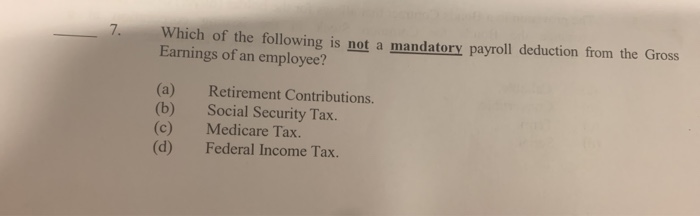

Solved Which Of The Following Is Not A Mandatory Payroll Chegg Com

The procedure of downloading the AP employee.

. Regardless of when you earned the income the W-2 reports income paid in the calendar year. Consider the following. AP Employee Pay Slip 2022 cfms ebadi Download payrollherbapcfssin Salary Slip As per the orders the Payscale for the AP employees has been renewed by the government of Andhra Pradesh.

If theyre different you will not find your total earnings on Form W-2 taxable wages for tax reporting purposes such as 403b Defined Contribution Plan DC Plan.

Solved Employers Must Deduct The Following From Each Chegg Com

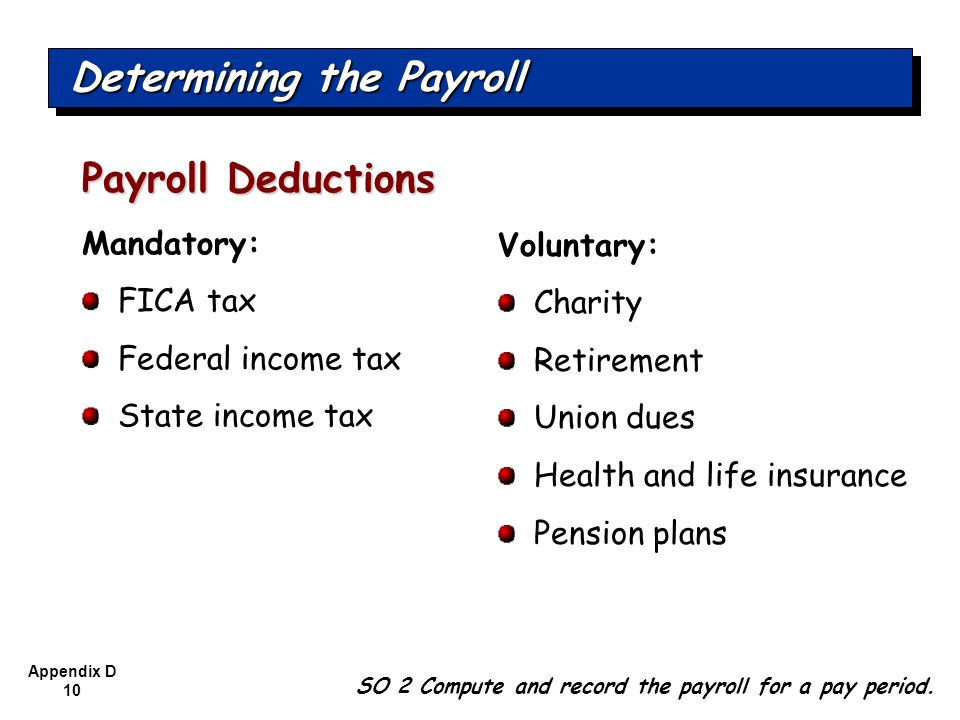

Financial Accounting Sixth Edition Ppt Download

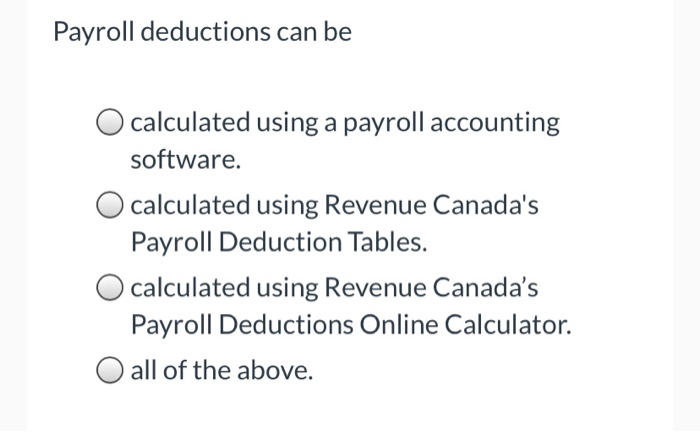

What Are Payroll Deductions Article

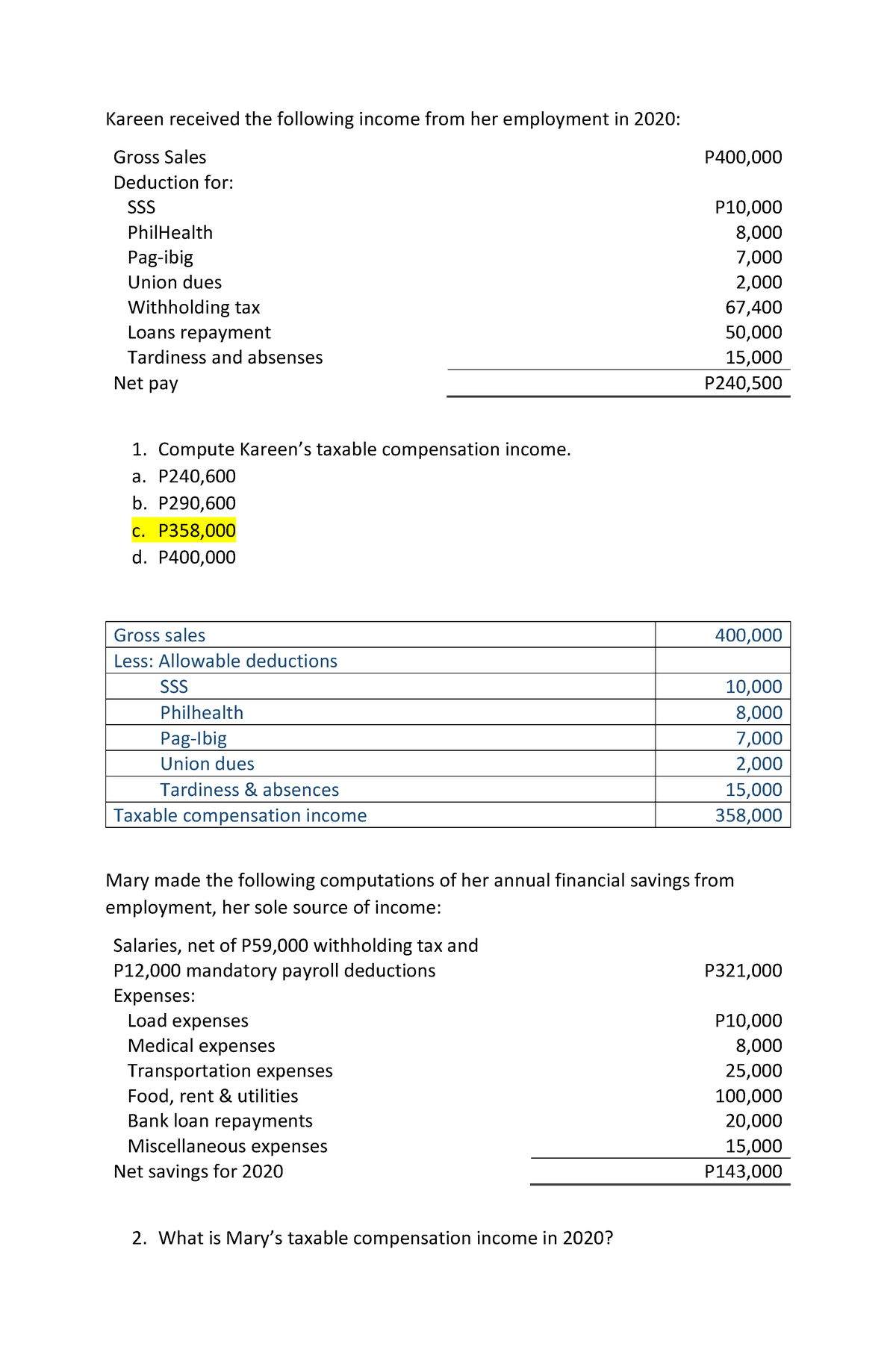

Tsr Individual Taxpayer Problem Pre With Answers Kareen Received The Following Income From Her Studocu

What Are Payroll Deductions Article

What Are Payroll Deductions Article

A Small Business Guide To Payroll Deductions In 2022 The Blueprint

Statutory Payroll Deductions For Employers In Kenya Enid Kathambi

What Are Employer Taxes And Employee Taxes Gusto

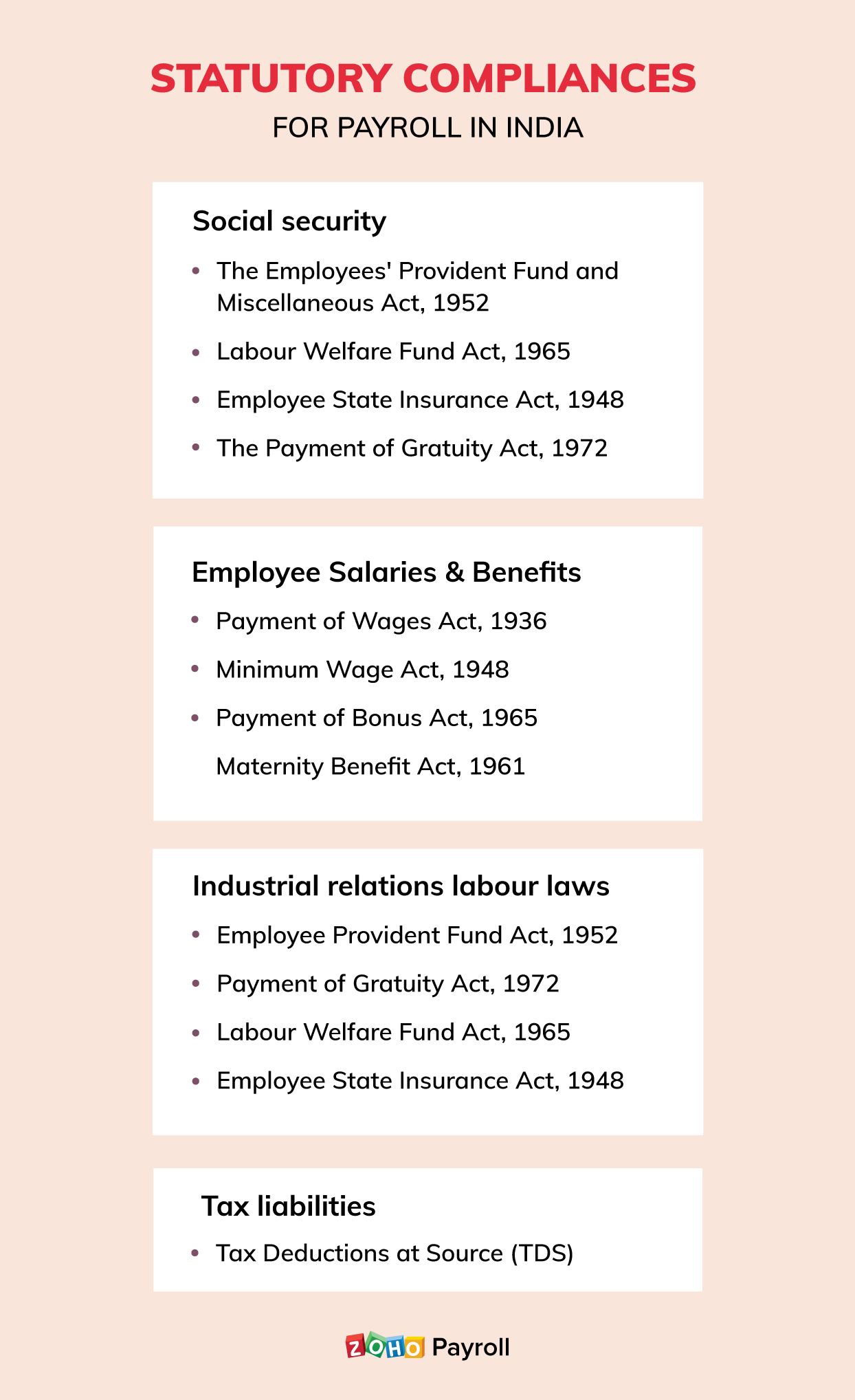

Statutory Compliance Guide To Payroll Compliance In India Zoho Payroll

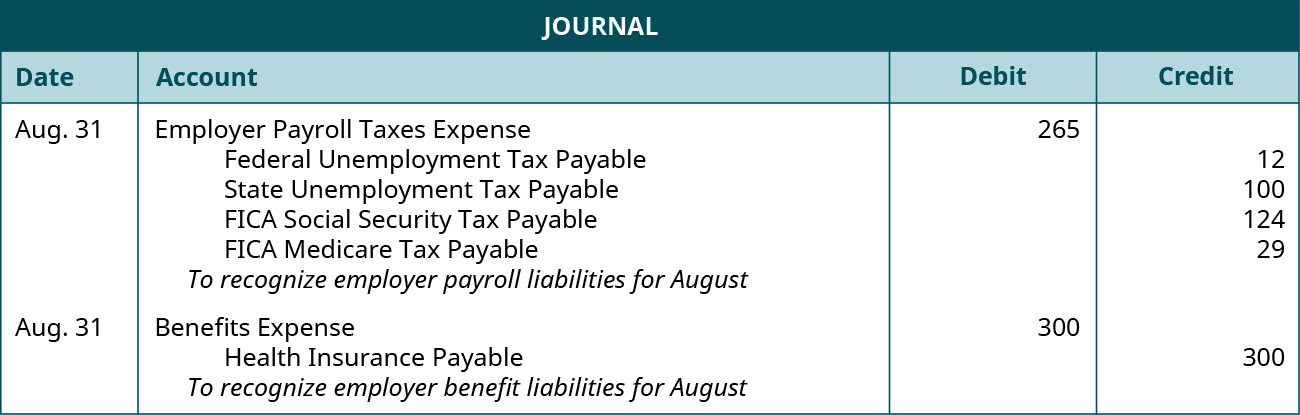

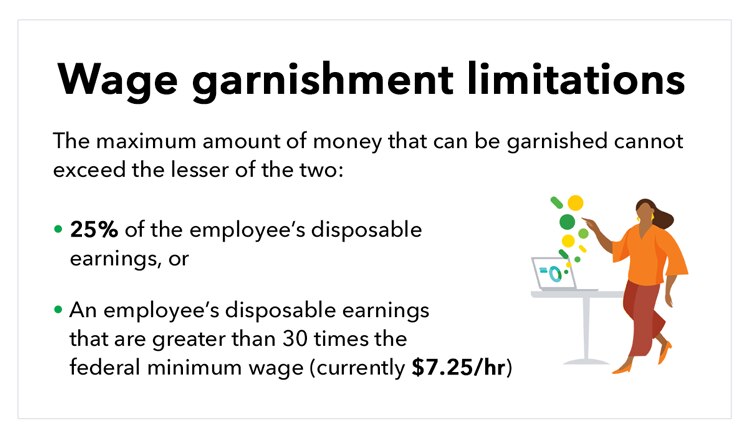

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

What Is A Payroll Deduction With Pictures

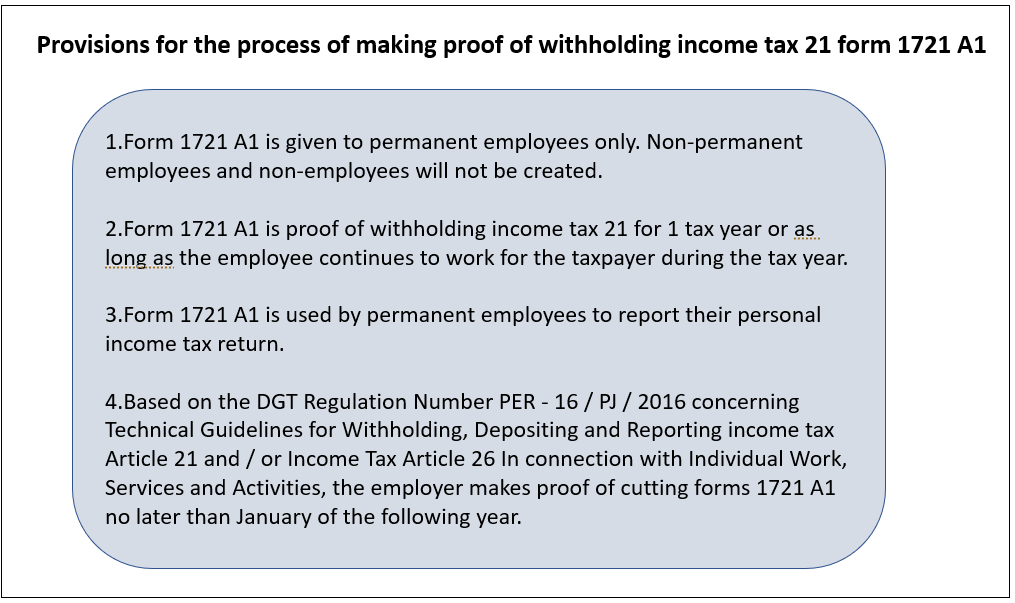

Indonesia Payroll And Tax Guide

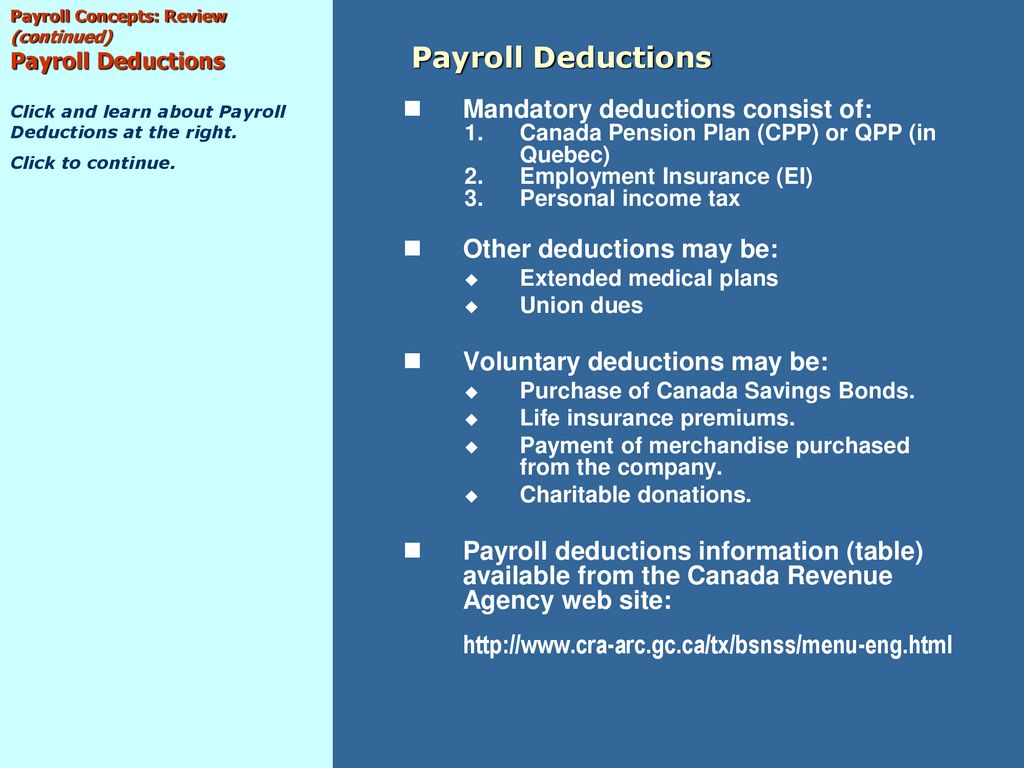

Setting Up The Payroll Module Ppt Download

What Are Payroll Deductions Article

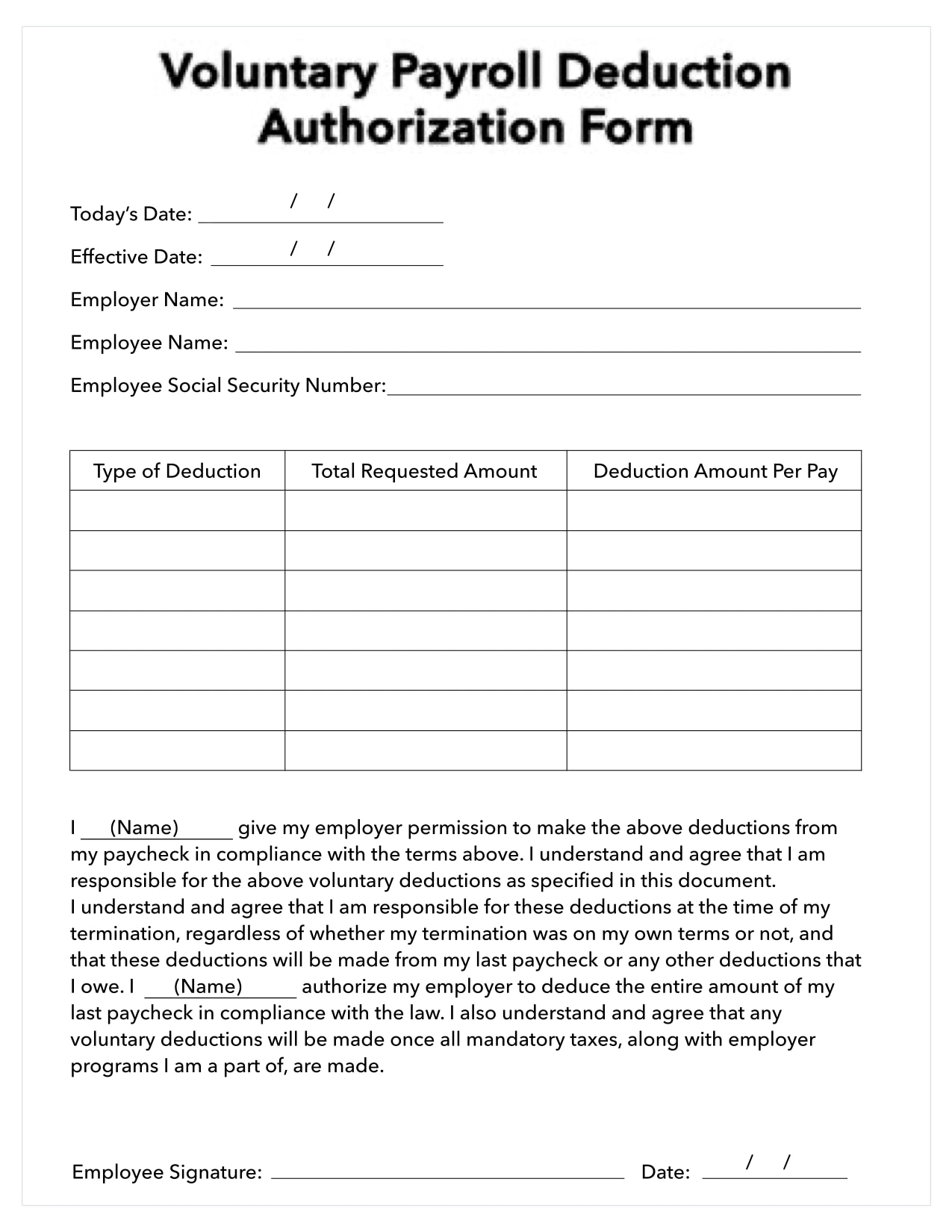

Payroll Deductions In Uae Mandatory And Voluntary Deductions

H 1 H 2 Learning Objectives Record The Payroll For A Pay Period 1 Record Employer Payroll Taxes 2 Discuss The Objectives Of Internal Control For Payroll Ppt Download

Comments

Post a Comment